As part of my realignment into the real world of deployments from the largely theoretical and marketing oriented world of industry analysis, I have observed the following.

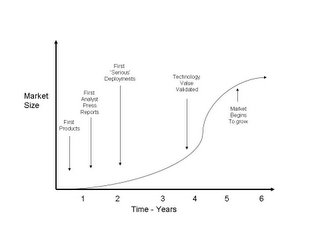

New fad's and market trends are usually pushed into the market by vendors and analyst's in tandem. Both typically start talking about them at the same time - hardly suprising. Both get fairly excited that this new trend is a great move for all concerned (ECM, XML. Taxonomy Builders, BPM, whatever). They then predict phenomenal growth over the next five years.

What then happens a year or two down the line is that the forecasts get revised downward and outward. Eventually the growth comes, but almost always much later than expected or forecast.

Why? Well I think what happens is that a seed is sown in the market and then needs time to gestate and mature. So a lot of noise at the start, then a fall from view for a year or two, then an emerging trend is spotted that enterprises are 'finally' embracing the new technology.

Its takes at least two to three years (often more) for these new technologies to take off - because (as I have said elsewhere) analyst firms and to some degree vendors hugely overestimate where their clients are currently at.

It is the same somewhat blindsided vision that Nick Carr exhibited in his famous HBR article - its not that he didn't have a point, it was that he believed the hype relating to the maturity of IT within enterprises.

There is no doubt there is a lot technology running in a typical enterprise, but when you start to dig in a bit deeper it is extremely common to find redundant functionality, failed projects and outdated and inneficient deployments. (For example expensive WCM/ECM systems that are being used simply to check files in and out - is extremely common!).

The problem here is that IT vendors rely on analysts heavily to provide them with real world perspectives, I don't believe that analysts are currently able to do this.

Conversely, I think enterprises need to rely far less on analysts for product selection exercises. Analyst firms such as Forrester, Gartner or my old firm Ovum can provide some excellent information - but nothing beats real world references from other buyers or implementers.

No comments:

Post a Comment